Introduction Having an emergency fund isn’t just smart, it’s a must. We all encounter unforeseen circumstances in life, such as unexpected illness, auto repairs, or job loss. A $1,000 savings can be a lifesaver in these moments. You don’t need to make huge sacrifices or overhaul your life to start building it. Small, steady steps… Continue reading Simple Steps to Save $1,000 Fast for Emergencies

Category: Save Money

Discover smart ways to save money with expert tips on budgeting, frugal living, discounts, and financial hacks. Start building your savings today!

How to Create an Emergency Fund With No Extra Money

According to the consensus of financial advisors, the foundation of individual financial stability is keeping an emergency reserve. When life presents you with unforeseen obstacles, such as a medical emergency, a job loss, auto maintenance, or unforeseen household needs, it acts as a cushion. But for most people, when every dollar is already being used,… Continue reading How to Create an Emergency Fund With No Extra Money

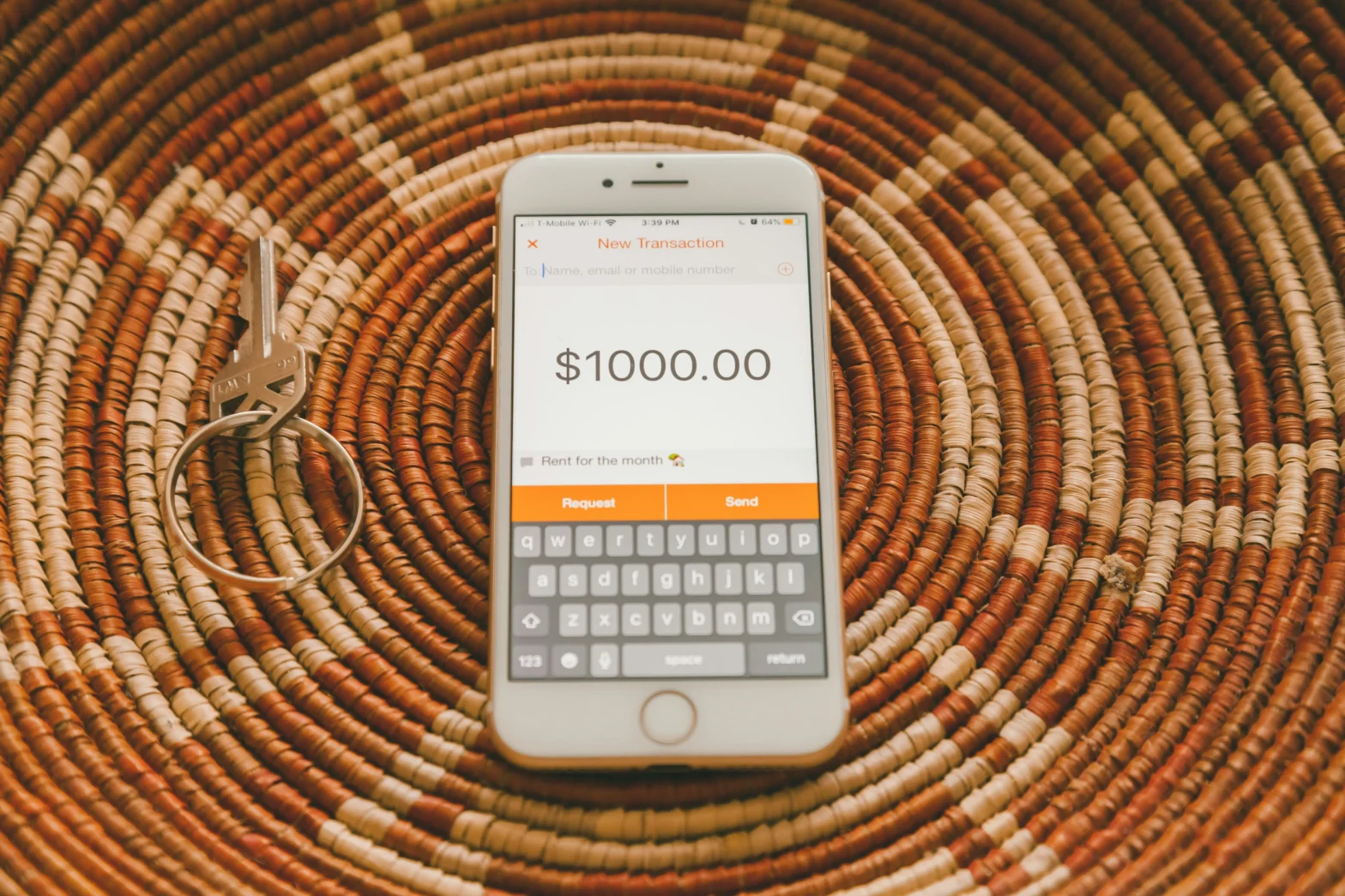

The Best Apps to Track Your Spending for Free

With a cashless society, the risk of spending more than you know is there. Subscriptions, one-click buying, and contactless cards all risk losing you in an ocean of wants masquerading as needs. Spending tracker apps are your savior here. They provide a convenient, real-time means of tracking where your money is heading, keeping you on… Continue reading The Best Apps to Track Your Spending for Free

Top 5 Ways to Cut Your Grocery Bill Without Losing Quality

GROCERY shopping is a fundamental and continuous financial obligation for all families. As essential as food is, it has been long realized that the increase in food prices has put an extra strain on monthly budgets. Yet, in the quest to cut down on expenditures, it remains necessary to maintain the quality of foods that… Continue reading Top 5 Ways to Cut Your Grocery Bill Without Losing Quality

Simple Steps to Open Your First Savings Account Today

A savings account is the first step towards a secure financial future. Whether you’re saving for an emergency fund, a dream vacation, or simply looking to grow your money in a safe manner, a savings account is a safe and liquid place to start. Thanks to the technological advances of our times, it’s now more… Continue reading Simple Steps to Open Your First Savings Account Today

How to Balance Your Main Job and Side Hustle Without Burning Out

In today’s fast pace and fast-digitizing life, most working professionals are choosing to supplement their principal income with the inclusion of side hustles. Be it freelance writing, graphic design, consulting, selling online, or content creation, side hustles have grown to be more than an addition to one’s principal income—they’re an entry point for passion projects,… Continue reading How to Balance Your Main Job and Side Hustle Without Burning Out

Hidden Fees: What Your Bank Doesn’t Want You to Know About Savings Accounts

Ever check your savings account and wonder where some of your money went? You’re not alone. Many people get surprised by unexpected bank fees. A savings account is a safe spot for your cash, letting it grow slowly. Knowing about fees helps you save more. The Usual Suspects: Common Savings Account Fees Some fees show… Continue reading Hidden Fees: What Your Bank Doesn’t Want You to Know About Savings Accounts

Emergency Fund vs. Sinking Fund: What’s the Difference?

Saving is only one aspect of smart money management; another is saving with a purpose. The emergency reserve and sinking fund are two effective strategies that can help you stay on top of your finances and reduce stress. Despite their similar sounds, they have quite different functions in your financial strategy. Let’s break down what… Continue reading Emergency Fund vs. Sinking Fund: What’s the Difference?

How to Budget Your Income Like a Pro: 50/30/20 Rule

You’re not the only person who has ever felt overpowered by intricate budgeting methods. The majority of conventional budgeting techniques can be more stressful than beneficial, requiring you to keep track of every cup of coffee and organize hundreds of monthly transactions. The 50/30/20 rule is applicable in this situation. It’s a straightforward, adaptable, and… Continue reading How to Budget Your Income Like a Pro: 50/30/20 Rule