Introduction

Having an emergency fund isn’t just smart, it’s a must. We all encounter unforeseen circumstances in life, such as unexpected illness, auto repairs, or job loss. A $1,000 savings can be a lifesaver in these moments. You don’t need to make huge sacrifices or overhaul your life to start building it. Small, steady steps can get you there fast. Building this quick cash reserve gives peace of mind and keeps financial stress at bay.

Why Saving $1,000 Quickly Matters

Setting aside $1,000 gives you a safety net when unexpected bills come up. It helps you avoid costly credit card debt or borrowing from friends. Having money ready means fewer sleepless nights over emergencies. Did you know that the average unexpected expense in America is around $1,000? This makes that amount perfect, manageable yet enough to handle many surprises. It’s a goal that’s simple to aim for and keeps you motivated to stay disciplined.

Assessing Your Finances to Create a Savings Strategy

Understand Your Income and Expenses

Start by knowing exactly how much money you bring in each month and where it goes. Track every dollar using apps or a budgeting spreadsheet. Being aware of your habits sharpens your focus on what to cut back.

Identify Spending Leaks

Check your bank statements for hidden costs. Do you have multiple subscriptions you no longer use? Are dining out or impulse buys eating into your income? Spotting these leaks lets you save more quickly. Cutting small expenses can add up.

Set a Clear Savings Timeline

Decide when you want to reach that $1,000 mark. Is it in two months, three, or four? Divide the total into weekly or monthly goals. For instance, saving $250 a month means you reach your target in four months. Having a timeline keeps you accountable.

Learn More: Emergency Fund vs. Sinking Fund: What’s the Difference?

Practical Steps to Save $1,000 Fast

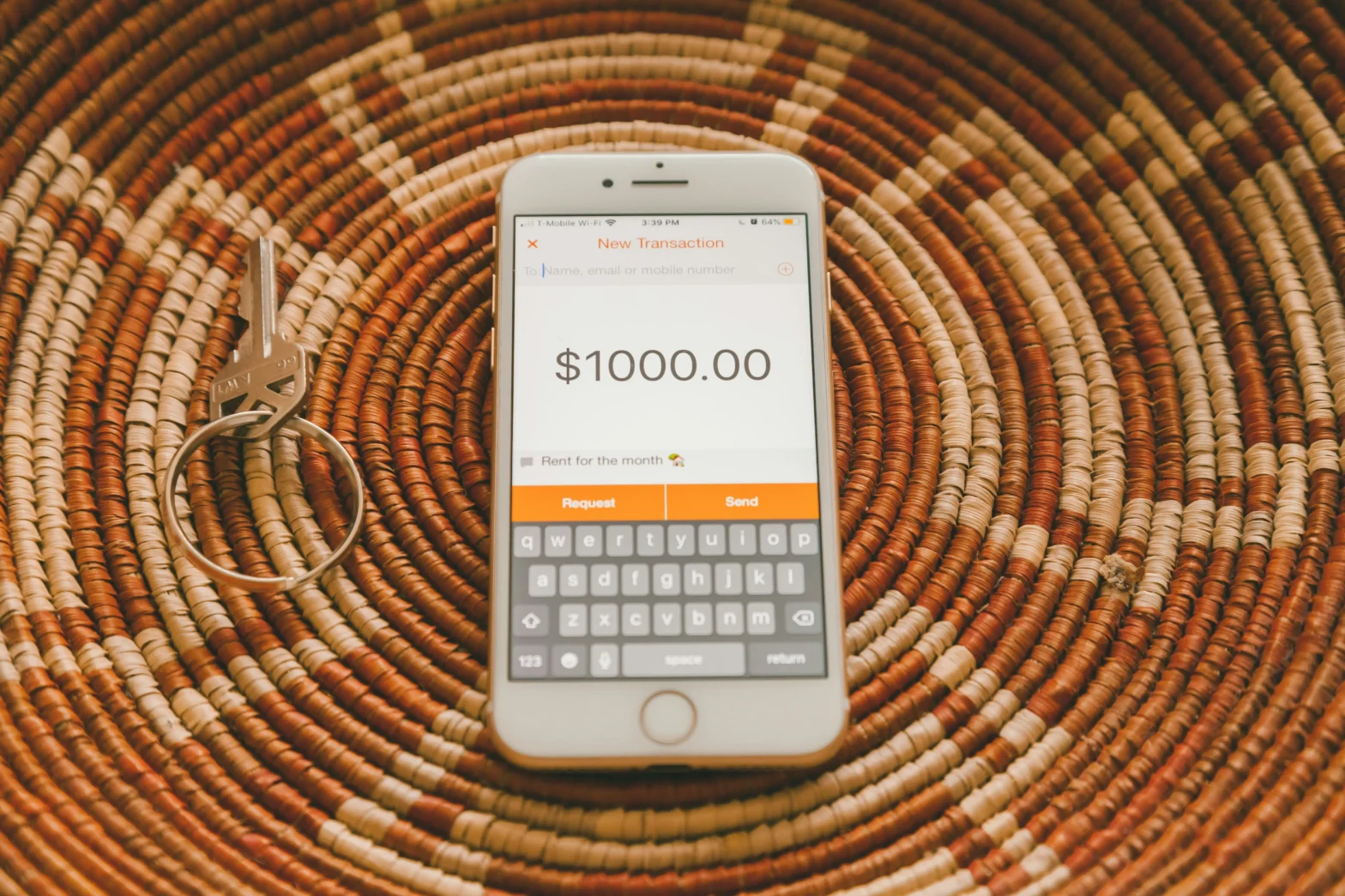

Create a Dedicated Savings Plan

Create a different account just for your emergency savings. Keeping it apart from your regular checking account prevents accidental spending. Set up automatic transfers right after payday. This way, saving becomes automatic and stress-free.

Increase Income Streams

Find quick ways to earn extra cash. Consider side gigs like dog walking, freelance writing, or yard work. Do you have unused gadgets or clothes? Sell them online. Every extra dollar accelerates your savings.

Reduce and Control Expenses

Cut boring but necessary costs. Avoid impulsive purchases, cut back on eating out, and cancel any unused subscriptions. Call your utilities and internet providers for discounts or lower rates. Small savings here and there add up fast.

Find Quick Wins and Unconventional Savings

Get money back when you shop by using cashback applications. Look for coupons and discount codes online. Join loyalty programs for stores you visit often. These small hacks give a boost to your savings without much effort.

Leverage Community and Employer Resources

Check if local programs help with bills or health costs. Also, see if your employer offers bonus savings plans or matched contributions. Using available resources can give your savings a quick lift.

Staying Motivated and on Track

Break your goal into mini milestones. Celebrate when you hit each one. Use charts or jars to visualize your progress. Find friends or online groups who share your goal. Keep reminding yourself why you want that $1,000, to handle emergencies confidently, no matter what.

Expert Tips and Proven Methods

Financial experts suggest tried-and-true methods like the 52-week savings plan, adapted for quick goals. One story? Someone needed the money fast and cut coffee daily, saving around $20 a week. Little changes can make a huge difference. These tips make the process less stressful and more realistic.

Conclusion

Building a $1,000 emergency fund quickly is about smart planning, small sacrifices, and staying committed. Set clear goals, cut unnecessary spending, and look for extra income. Don’t wait, start today. Your future self will thank you for having that safety net when the unexpected happens. Remember, even a little effort now can bring big peace of mind later. Get moving and make your emergency fund a reality.