Investing might feel overwhelming if you have limited funds to start with. However, beginning early, even with small amounts is an effective way to build wealth over time. You don’t need a large sum upfront to get going. Making consistent, modest investments can establish a strong financial base. Thanks to today’s easy-to-use apps and platforms,… Continue reading How to Start Investing with Little Money: A Beginner’s Step-by-Step Guide

5 Simple Steps to Lower Your Monthly Student Loan Payment

Managing student loans can feel overwhelming, particularly when your debt increases faster than your earnings. But you’re not alone in this, and there are effective ways to simplify your payments. If you want to reduce the burden of your monthly loan bills, these five simple steps can guide you. Let’s get started. Understand Your Student… Continue reading 5 Simple Steps to Lower Your Monthly Student Loan Payment

How to Find Your First Freelancing Gig and Build Trust Quickly

Beginning a freelancing career is never easy. You desire to do something you love and earn a living from it, but getting the first client is always the greatest challenge. Newbies are often confronted with stiff competition and concerned about building trust right from the start. This article gives you easy steps to get your… Continue reading How to Find Your First Freelancing Gig and Build Trust Quickly

How to Balance a Full-Time Job and a Side Business

Do you want balance your full time job and a side husle business? you are not a lone, how fast-paced and dynamic the economy has become, more professionals are choosing to start side enterprises in order to supplement their income, pursue their passions, or eventually become full-time entrepreneurs. The idea of working a side business… Continue reading How to Balance a Full-Time Job and a Side Business

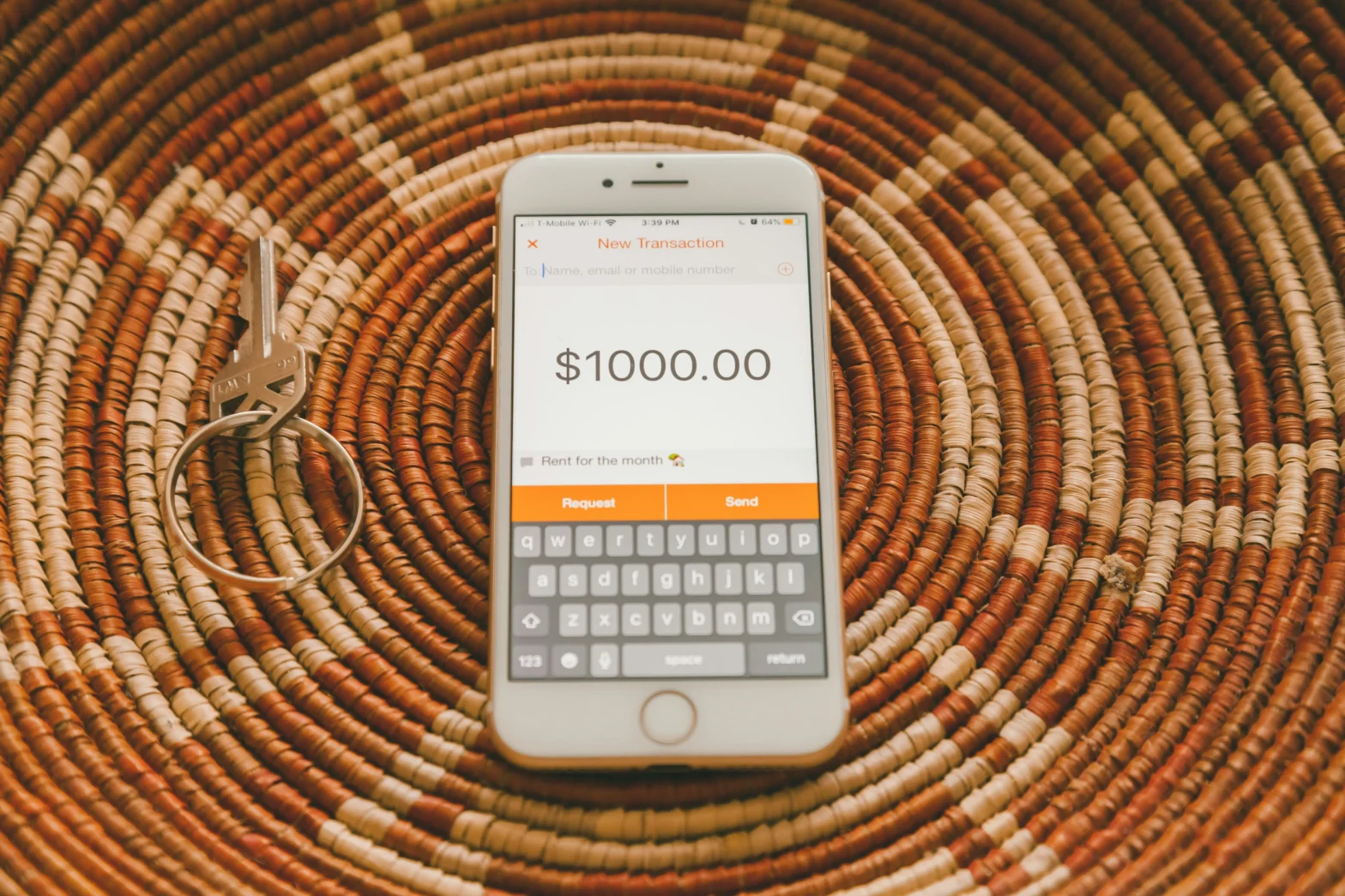

Simple Steps to Save $1,000 Fast for Emergencies

Introduction Having an emergency fund isn’t just smart, it’s a must. We all encounter unforeseen circumstances in life, such as unexpected illness, auto repairs, or job loss. A $1,000 savings can be a lifesaver in these moments. You don’t need to make huge sacrifices or overhaul your life to start building it. Small, steady steps… Continue reading Simple Steps to Save $1,000 Fast for Emergencies

How to Create an Emergency Fund With No Extra Money

According to the consensus of financial advisors, the foundation of individual financial stability is keeping an emergency reserve. When life presents you with unforeseen obstacles, such as a medical emergency, a job loss, auto maintenance, or unforeseen household needs, it acts as a cushion. But for most people, when every dollar is already being used,… Continue reading How to Create an Emergency Fund With No Extra Money

The Best Apps to Track Your Spending for Free

With a cashless society, the risk of spending more than you know is there. Subscriptions, one-click buying, and contactless cards all risk losing you in an ocean of wants masquerading as needs. Spending tracker apps are your savior here. They provide a convenient, real-time means of tracking where your money is heading, keeping you on… Continue reading The Best Apps to Track Your Spending for Free

Top 5 Ways to Cut Your Grocery Bill Without Losing Quality

GROCERY shopping is a fundamental and continuous financial obligation for all families. As essential as food is, it has been long realized that the increase in food prices has put an extra strain on monthly budgets. Yet, in the quest to cut down on expenditures, it remains necessary to maintain the quality of foods that… Continue reading Top 5 Ways to Cut Your Grocery Bill Without Losing Quality

Simple Steps to Open Your First Savings Account Today

A savings account is the first step towards a secure financial future. Whether you’re saving for an emergency fund, a dream vacation, or simply looking to grow your money in a safe manner, a savings account is a safe and liquid place to start. Thanks to the technological advances of our times, it’s now more… Continue reading Simple Steps to Open Your First Savings Account Today

How to Balance Your Main Job and Side Hustle Without Burning Out

In today’s fast pace and fast-digitizing life, most working professionals are choosing to supplement their principal income with the inclusion of side hustles. Be it freelance writing, graphic design, consulting, selling online, or content creation, side hustles have grown to be more than an addition to one’s principal income—they’re an entry point for passion projects,… Continue reading How to Balance Your Main Job and Side Hustle Without Burning Out